by Mel Green | posted originally on Bent Alaska

Court documents in the divorce of Allen Prevo, son of Anchorage Baptist Temple pastor Jerry Prevo, and Holly Jo Prevo raise questions about ABT religious exemption housing. Or, in the judge’s words, “if there was a tax appraiser or a reporter from the Anchorage Daily News, things would not look good… it’s pretty loosey-goosey to me.”

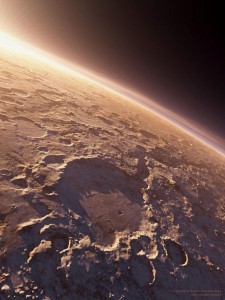

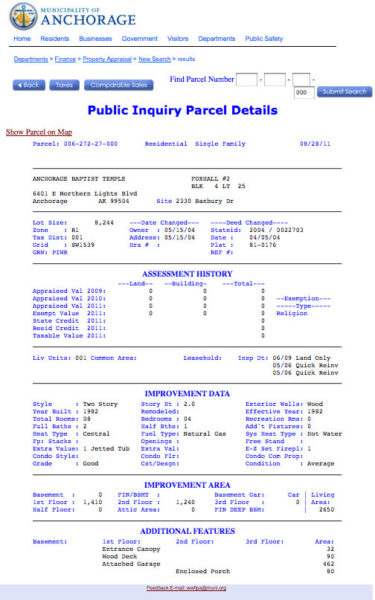

2330 Banbury Circle

Citing Alaska Statute § 25.20.120, which provides the option of sealing court records in proceedings involving child custody, attorney Wayne Anthony Ross on August 3 filed a motion to seal the records in the case of Allen Prevo v. Holly Jo Prevo (3AN-10-08113CI). The motion was filed on the same day that Anchorage Superior Court Judge Frank A. Pfiffner granted a decree of divorce. Arguing to seal the records, Ross wrote,

The plaintiff’s father (the children’s grandfather) is a high profile individual in the State of Alaska and is a well known, national figure. There are several journalists who would delight in airing any “dirty laundry” attached to the Prevo family. Access to these court records would provide little material that would be of any benefit to the public, and the negative publicity which would result could have a strong negative effect on the children.

Phyllis Shepherd, the defendant’s lawyer, countered on August 16:

It appears that plaintiff’s primary concern is, not so much the protection of his children, but to protect his father “a high profile individual in the state of Alaska and a well known national figure.”

The “high profile individual” is, of course, Jerry Prevo, pastor of the Anchorage Baptist Temple, who has long been a powerful figure in Anchorage and the state. He’s well-known to Anchorage’s LGBT community as a prominent leader in opposition to equal rights under the law for LGBT people, leading the fight against three ordinances which granted those rights in 1975, 1992, and 2009 — all of which passed the Anchorage Assembly, only to be reversed (twice through mayoral veto, once through vote of a successor Assembly). He had close ties with Jerry Falwell, founder of the Moral Majority, and founded Alaska’s chapter of the Moral Majority in 2000. In 1985, Prevo accompanied Falwell on a widely publicized “Freedom Mission” to South Africa, returning to Anchorage to speak the praises of then-president and apartheid advocate P.W. Botha. Since at least 2003, Prevo has been chair of the board of trustees of Liberty University in Lynchburg, which Falwell founded as Lynchburg Baptist College in 1971.

The “high profile individual” is, of course, Jerry Prevo, pastor of the Anchorage Baptist Temple, who has long been a powerful figure in Anchorage and the state. He’s well-known to Anchorage’s LGBT community as a prominent leader in opposition to equal rights under the law for LGBT people, leading the fight against three ordinances which granted those rights in 1975, 1992, and 2009 — all of which passed the Anchorage Assembly, only to be reversed (twice through mayoral veto, once through vote of a successor Assembly). He had close ties with Jerry Falwell, founder of the Moral Majority, and founded Alaska’s chapter of the Moral Majority in 2000. In 1985, Prevo accompanied Falwell on a widely publicized “Freedom Mission” to South Africa, returning to Anchorage to speak the praises of then-president and apartheid advocate P.W. Botha. Since at least 2003, Prevo has been chair of the board of trustees of Liberty University in Lynchburg, which Falwell founded as Lynchburg Baptist College in 1971.

Prevo also has ties with other national Christian figures, including Franklin Graham, and is on the board of directors of Graham’s charity Samaritan Purse. He accompanied former Alaska governor Sarah Palin on a Samaritan Purse mission to western Alaska. Prevo has several times been a member of Alaska’s delegation to the national Republican convention, at least twice serving as the delegation’s chair. At the 2009 convention, according the the Washington Post political blog The Trail, he handed Palin his cell phone for her to accept congratulations from Franklin Graham for her nomination as vice presidential candidate. His power is such that many political candidates feel compelled to take what Amanda Coyne of Alaska Dispatch once termed “the perp walk at Anchorage Baptist Temple” to introduce themselves to his congregation. The funeral of Sen. Ted Stevens was held in his church.

Wayne Anthony Ross’ Hummer with WAR vanity plates

Allen Prevo’s attorney, Wayne Anthony Ross, is also widely known. In Anchorage he’s famous for driving a bright red Hummer bearing vanity plates with his initials, WAR. In 2009 he was Gov. Sarah Palin’s nominee for Alaska attorney general, and distinguished himself by becoming the only cabinet nominee in Alaska state history to fail to be confirmed by the Alaska Legislature. His candidacy had been widely opposed by Alaska Natives, women, and the LGBT community — who weren’t favorably impressed by a 1993 letter he wrote to the Alaska Bar Rag (of the Alaska Bar Association) calling gays and lesbians “degenerates” who practiced “sexual perversion” and were “”immoral in the eyes of anyone with intelligence.” Asked in a confirmation hearing if he could fairly represent LGBT Alaskans, Ross replied,

Let me give you an analogy. I hate lima beans. I’ve never liked lima beans. But if I was hired to represent the United Vegetable Growers, would you ask me if I liked lima beans. No. If I disliked lima beans. No. Because my job is to represent the United Vegetable Growers.

Wayne Anthony Ross is perhaps not correct when he writes — as his motion to seal the court records goes on to say —

The plaintiff respectfully submits to the court that it is in the best interests of the children to have these records shielded from public scrutiny.

In fact, there may in fact be “benefit to the public” — a benefit having nothing to do with the Prevo kids — in leaving the court records open to scrutiny. That’s getting down to the bottom of what’s going on with Jerry Prevo’s son’s housing.

Background

Allen and Holly Jo Prevo married on May 1, 1992 and had three children.

Allen Prevo, 43, is the only child of Jerry and Carol Prevo. He began working for his father’s church, Anchorage Baptist Temple, in 1983 as a lighting director and TV consultant, and currently is ABT’s audiovisual and computer technician in charge of virtually everything having to do with ABT’s television ministry — Sunday broadcasts, commercials, advertising, and lighting for plays. He also is an ordained pastor, though court records mention only a high school education, no college or seminary work. In 1997 while working at ceiling level at ABT, he fell 24 feet from a catwalk, landing on a railing and suffering severe injuries to his ribs and thoracic spine. As a result, he has a chronic pain condition which is managed with the pain medication Oxycontin (oxycodone). Prevo was the plaintiff in the case, with Ross stating on his behalf in the Complaint for Divorce of May 17, 2010,

There exists an incompatibility of temperament between the parties which renders a life together burdensome and intolerable. However, plaintiff does not wish a divorce and believes that if the defendant will involved herself in counseling with him, take the necessary time, and make the necessary effort, then this marriage could be saved. If the defendant refuses, however, to involve herself with plaintiff in counseling, take the necessary time, and make the necessary effort to try and save this marriage, then a divorce may be necessary.

The Plaintiff’s Trial Brief of March 18, 2011 elaborates:

In April 2010 Holly announced to Allen that she wanted a divorce. Allen filed for divorce on 10 June 2010 because he feared Holly was planning to take the children out of the state. Rather than wanting a divorce, Allen hoped to get Holly to agree to involve herself, with him, in marriage counseling. Holly, however, has refused to work toward saving the marriage. Instead, she has advised Allen that she plans to move to California after the divorce.

Holly Jo Prevo nee Jaggers, 39, currently works as a customer service representative for AT&T, though during most of her marriage to Allen Prevo she was out of the workforce, staying in the home as a homemaker and primary caregiver of the couple’s three kids. Previously she had been involved in volunteer activities centered around Anchorage Baptist Temple and the Anchorage Christian School, including directing the children’s choir and coaching cheerleading.

At issue in the divorce was the custody of the three minor children, possible child and spousal support, attorney’s fees, and the equitable division of marital property. The Amended Decree of Divorce of August 3 ultimately granting them joint legal custody of the two younger children, with Allen having primary physical custody of them; and Holly being granted sole legal and primary physical custody of their oldest child. Despite Allen’s initial claim in his Complaint for Divorce that “Defendant is financially capable of paying spousal support to plaintiff,” Judge Pfiffner found Holly’s claim to be the financially disadvantaged party — with an annual income in the area of $60,000 less than Allen’s — to be correct, writing in the Findings of Fact and Conclusions of Law,

Because of her limited income and assets and smaller earning capability, Holly needs a disproportionate share of the marital estate. Accordingly, the court has divided the estate on a 55/45 basis in favor of Holly.

Holly’s name was also restored to Holly Jo Jaggers.

Some details of the settlement, as well as some of the Finding of Fact incorporated in the decree, are still being argued about between the parties, resulting in further motions in countermotions.

The marital home

But one item in particular remains of public interest: the marital home at 2330 Banbury Drive. A search on the property at the Municipality of Anchorage Real Property Information site confirms that the property is, as discussed in court records, owned by the Anchorage Baptist Temple. Furthermore, it’s got a religious exemption from taxes. From there, the questions begin.

A nchorage news junkies may remember that in April 2004, municipal tax assessors revoked the exemption for four ABT-owned houses that were determined not to qualify for a religious exemption because none of the people living in them was “a bishop, pastor, priest, rabbi, minister or religious order of a recognized religious organization” as specified in state law about property tax exemptions. Three were teachers at the ABT-affliated Anchorage Christian Schools. The fourth was a janitor. Then, a couple of years later, the Municipality discovered that an additional six ABT-owned houses were occupied by teachers.

nchorage news junkies may remember that in April 2004, municipal tax assessors revoked the exemption for four ABT-owned houses that were determined not to qualify for a religious exemption because none of the people living in them was “a bishop, pastor, priest, rabbi, minister or religious order of a recognized religious organization” as specified in state law about property tax exemptions. Three were teachers at the ABT-affliated Anchorage Christian Schools. The fourth was a janitor. Then, a couple of years later, the Municipality discovered that an additional six ABT-owned houses were occupied by teachers.

Anxious to retain its tax exemption on those houses, ABT enlisted the help of assistant pastor Glenn Clary, who also happened to be the treasurer of the Alaska Republican Party, to go down to Juneau and lobby legislators to fix things. The Republican-dominated legislature was quick to respond: in March 2006, Senate President Ben Stevens drafted language which added “an educator in a private religious or parochial school” to the list of people whose residence in a house made the house exempt from property taxes. Furthermore, the new language defined a “minister” to be someone who is considered one and is “employed to carry out a ministry” of a religious organization. Stevens then asked Sen. Bert Stedman, chairman of the Senate Community and Regional Affairs Committee, to introduce the new language into a redraft of an obscure property tax bill that Sen. Con Bunde had introduce the previous year. Public testimony on the bill a few days later was aligned squarely against the bill, but legislators advance it anyway, and it ultimately passed and was signed into law by Gov. Frank Murkowski. The ACLU of Alaska sued, but ultimately a Superior Court judge found the new law constitutional.

It’s not completely clear from the court paperwork, but it’s possible that the religious exemption for the house the Allen and Holly Jo Prevo family lived in came out of this law — the portion of it which permits a religious organization to define for itself what a “minister” who is “employed to carry out a ministry” is. Allen Prevo is, again, an ordained minister — despite no record in the court documents to indicate his education went past high school to college, much less grad school or a seminary. And, Allen Prevo is employed to carry out ABT’s television ministry. Thus: the ABT house he lives in is tax-exempt.

But there’s still plenty of unclarity to be found in the court documents. For example, in paragraph 4 of the Counterclaim contained in the defendant’s (Holly’s) Answer to Complaint for Divorce (filed June 30, 2010), Phyllis Shepherd on Holly’s behalf asserts,

Defendant asserts that she is a disadvantaged spouse and is in need of spousal support to be paid by the Defendant.

Wayne Anthony Ross on behalf of Allen Prevo denied this, writing in the January 26, 2011 Answer to Counterclaim,

The defendant is gainfully employed and is continuing to live in the marital home while the plaintiff continues to pay the mortgage.

But how could Allen have been paying the mortgage when he didn’t own the home? (At this point, also, Ross and Prevo were continuing to insist that Holly, with an annual income perhaps one quarter of Allen’s, should pay him spousal support.)

The details begin to come clear in a significantly unclear way in on the first day of the divorce trial, which took place on April 5, 2011. A summary of the trail is included in the court file. These notes, prepared by court clerks during testimony, generally include the statements made by witnesses, but not (except in rare instances) the questions asked by attorneys — so it’s rather like hearing only one side of a telephone conversation. Occasionally Judge Pfiffner — identified in the record as COURT — also steps in with a few questions, as in this passage, in which Allen Prevo is being examined by Wayne Anthony Ross. Typos and errors here are as in the original; comments or explanation from me are in square brackets.

Direct Exam continues by Mr. Ross

Plaintiff ex. 6 – reference [Plaintiff identifies exhibit 6]

(spreadsheet of property, to be split 50/50)

(fair thing to do, not written agreement between us the church)

(been working for ABT fro 15 years and they will have rent go to equity in the home. If you stay in this home an its paid off its our home, verbal agreements and nothing in writing)

plaintiff ex. 3 – ID [Plaintiff identifies exhibit 3]

(verbal agreement we wrote up to be fair on this issue, written up…., not sure of date)

(written up for this litigation, since she decided on this divorce)

(if I were to quit ABT they would get the home, its in their name)

(took what we put toward the home, rent to own, transfer equity from other home to his home and they appliances and new boiler etc.,)

($322,888.50 valued at, yes)

(we picked out refrigerator and the washer and dryer, church put up the money and added to what we owed the church)

(correct)

(the previous house was also owned by ABT)

(got credit for the first ABT home toward the 2nd ABT home)

(yes, made repairs but paid for by ABT, increased what we owed on the home)

(They also paid fire insurance…,)

Clerk change back to Holly Fuentes

Exhibit(s) Offered

Court inquires of Allen Prevo

Allen Prevo

(No, the church paid the house off so I don’t know, I guess because we’re paying the church there’s no mortgage

(It’s listed as Anchorage Baptist Temple…if I had my paystub I could show you exactly

(We were paying a bi-weekly payment…toward the equity of the home

(That was…yes sir…$770 monthly, on the second page

(Yes…not sure if it’s fifteen years, started in 2005…started ABT in 1983

(It was a good deal sir

(I’ve stated to Holly, if I keep the kids for the school year I’d purchase the house and get money from the church to pay her half and then I’d owe my dad an arm and a leg

(If I don’t have the kids for the school year I don’t need that big of a house

(We’d default on the mortgage and we’d see…we’d divide it up

(They’d end up paying us fair market value…no sir

[…]

(Holly did all the financing when we were married

(This came from the church, what we have paid since 2005, how much we paid for the house

(Yes {paid by the Baptist Temple}…and added to…yes…correct

COURT:

-Anchorage Baptist Temple, your father, whoever is going to agree to all of this…that’s a stretch

Ross

-If he decided to become a Presbyterian…nothing requiring him to pay them

COURT:

-I’m willing to have you explain a lot more but if there was a tax appraiser or a reporter from the Anchorage Daily News, things would not look good

-I’m seeing and hearing all this stuff…I have to deal with it only in the context of this case

-Who owns this, is there equity, how it will be paid out, it’s pretty loosey-goosey to me

On the second day of the trial, April 7, 2011, Ronald Thomas Slepecki, a college professor at Wayland Baptist, was examined as a witness for the defense by Holly’s attorney Phyllis Shepherd. Before going to Wayland, Slepecki had been a staff member at ABT.

(I retired from the Air Force…in 1991-1995…I was over a lot of the children so I had interactions with…mostly those four years I knew of Allen and Holly

(That all changed in…we were family, they’d help sit our kids…both were great

(This is very difficult for me because I love them both, I’m here testifying to the truth, not here to be on one side or the other

(Well, yes…whenever you go up against your old bosses son is the way it could be seen

(I’ve worked for his dad for quite a long time…yes, Pastor Prevo…can be very tough to deal with

(He does wield a lot of power as it relates to that church…our government and the way it’s structured

(A Pastor is a Pastor…he does all the hiring and firing so it’s difficult to be put in a situation

[…]

(Yes, how it works…

Ross

-Objection, relevance

COURT:

-Overruled

Ronald Thomas Slepecki

(Any church atmosphere…that means the property is owned by the church and an ordained minister lives in that property

(So I met that, I was an ordained minister…therefore, the church does not have to pay taxes on that home because I meet those requirements

(Two would be later on if I move out of the church house…and purchased my own home, the church can designate a certain part of your salary as a housing allowance

(The rental value…then you have to justify that…all the things have to add up to that

(There’s one more than occurs at Anchorage Baptist Temple, there’s a third setup that relates to Allen and Holly’s home, that has been given to folks that are higher up

(I never got that, I asked and was denied

Ross

-Objection, speculation

Ronald Thomas Slepecki

(The church carries the note so they give you a better interest rate and you work off that and pay the church

Based on Allen’s first-day testimony, apparently the rent which Allen paid went towards equity in the home in some kind of unwritten, purely verbal agreement between him and ABT, or between him and his father. But after it became clear that there would be a divorce, the agreement was finally put down on paper. Which may possibly be what’s being referred to here, from Day 3 of the trial, held July 12, 2011 (though to verify someone would have to listen to the recording and/or examine the exhibit):

Holly Prevo

(His dad gave us that…his fingerprints would be all over that document, he’s fully aware of document…original document has been signed

(Allen signed it and Jerry Prevo…no doubt whatsoever

Rebuttal: Cross Examination by Mr. Ross

Holly Prevo

(I heard Jerry Prevo say…unless he’s a liar…yes, I did see it signed

Meanwhile, the rent that Allen paid, which went towards this supposed equity in the home, actually appears to have come out of one of the components of Allen’s compensation as an ABT employee — his housing allowance of $10,029.24. In other words, he was given a housing allowance, which he used to pay rent which went towards his equity.

(His total compensation, per Holly’s Answer to Complaint for Divorce as well as the final Findings of Fact, includes: Salary$58,844; housing allowance $10,029; cell phone $420; utility allowance $3,000; 403(b) contribution $9,500; vacation 4 weeks; for a total of $81,793. Additionally, there was free private school tuition for each child enrolled at Anchorage Christian School, up to about $11,750/year; medical reimbursement for 1/2 family medical expenses not otherwise covered by health insurance; ABT-provided truck insurance; and retirement held in Vanguard mutual funds valued at about $100,000. Holly in the meantime had an annual income in 2010 of $24,931.)

Judge Pfiffner, as he said on Day 1 of the divorce trial, could only do the best he could within the context of the case. As summarized in the Findings of Fact:

ABT has legal title to the residence at 2330 Banbury Drive in Anchorage. (Ex. G). There is no deed of trust on the residence. However, ABT and Allen Prevo had an unrecorded agreement in place whereby Allen owns the equity in the residence. (Ex. 3) The agreement provides Allen Prevo is vested with the equity from prior ABT housing. (Id.) The difference between the prior equity and the purchase prices was the initial paper mortgage amount on the Banbury residence. (Id.) Each pay period, a percentage of Allen Prevo’s annual housing allowance was subtracted from Allen’s paycheck and is applied to reduce the paper mortgage balance on the Banbury residence. (Id.) Essentially, Allen Prevo’s housing allowance is an interest free reduction in Allen Prevo’s paper mortgage. (Id.) The paper equity on the Banbury residence is a marital asset. [emphasis added]

Maybe we need what Judge Pfiffner mentioned in the first day of the trial —

-I’m willing to have you explain a lot more but if there was a tax appraiser or a reporter from the Anchorage Daily News, things would not look good

-I’m seeing and hearing all this stuff…I have to deal with it only in the context of this case

-Who owns this, is there equity, how it will be paid out, it’s pretty loosey-goosey to me

Yep, looks pretty loosey-goosey to me, too, an unschooled renter-for-life like me, who has never owned a house in my life.

Tax assessors, Anchorage Daily News, or any other journalists who just want to get down to the truth — whether or not you “delight in airing any “dirty laundry” attached to the Prevo family” — please have a look at this, will you?

The court file is not yet sealed.

Update 1: I’ve been informed that the court file was sealed at about 1:00 PM on August 29, several hours after this post went live on Bent Alaska.

Update 2: The file was not actually “sealed”: the order reads “Order Granting Motion in Part ~ Motion for Documents to be Filed Under Protective Seal ~ Before the court is plaintiff’s motion for the files in the above captioned case to be maintained under seal or kept confidential. Plaintiff’s motion is granted in part and denied in part. The court finds that the public interest in disclosure is presently outweighed by a legitimate interest in confidentiality. See Alaska R. Admin. 37.6(b). Specifically, the court finds that confidentiality should be maintained in order to protect the best interests of the minor children. See AS 25.20.120. Accordingly, all transcripts and documents filed in the above captioned case shall be kept confidential within the meaning of Alaska Rule of Administration 37.5(c)(4). Plaintiff’s motion to maintain the file under seal is denied. This order is without prejudice to a motion filed by any member of the public seeking access to the case file in whole or in part.”

Please note that there are other and much more personal aspects of this divorce, which I chose not to discuss in this story, which have bearing on the the judge’s decision on this matter.

Update 3: “Confidential” and “sealed”: under Alaska Rule of Administration 37.5(c)(4) and (c)(5):

(4) “Confidential” means access to the record is restricted to:

(A) the parties to the case;

(B) counsel of record;

(C) individuals with a written order from the court authorizing access; and

(D) court personnel for case processing purposes only.

(5) “Sealed” means access to the record is restricted to the judge and persons authorized by written order of the court.

The judge ordered the records to be kept confidential, but denied the plaintiff’s motion to seal them.

References

Besides the court documents cited within the text, or references which were linked, these references were also used:

- “Co-sponsors flummoxed by hijacking of tax bill – BAPTIST TEMPLE: Exemption from taxes for church’s housing for teachers shoehorned into measure” by Richard Richtmyer (Anchorage Daily News, March 10, 2006).

- “Committee gets earful about property-tax bill – EXEMPTION: No one spoke in its favor, but it advanced anyway” by Matt Volz, Associated Press (Anchorage Daily News, March 12, 2006).

- “Temple’s homes for its teachers are tax exempt – COURT RULING: Alaska ACLU had sued to stop the practice” by Sheila Toomey and Megan Holland (Anchorage Daily News, July 4, 2008).

I started reading The Hazards of Space Travel: A Tourist’s Guide

by Neil F. Comins off my Kindle for iPhone as relaxing lunchtime reading at the Bear Tooth the day before Thanksgiving — excellent accompaniment for Yucatan lime soup, chicken Ceasar salad, & that dark smooth Moose’s Tooth Pipeline Stout!